Since time immemorial, people have been trying to cheat.

What do I mean?

People have been trying to steal money from others.

It turns out, the way to do this in Bible times was by using ‘false weights and measures.”

What does that mean?

Ever seen old scales? Before newer methods existed, people used ‘balance scales’.

If you don’t know how these work, you put your product on one side and your ‘weight’ on the other side. So, if you are going to sell a pound of grain (at a certain price), you would pour the grain on to one side, and put the pound weight on the other side. Once the scale was ‘even’, you knew the weights were the same.

So, in order to cheat people, merchants would have a weight that was a little lighter than a pound on one side, but still charge for a pound of product. That would be “stealing” some money from the buyer, who thought he was getting a pound of wheat. Tricky tricky.

This is decried in the Bible and other places as immoral.

But, somebody came up with an even better idea. And that is, to falsify the value of the money that is used to purchase.

When I falsify my weights and measures, I got more gold or silver than I should have. Gold and silver cannot be printed. You have to get their value from somewhere. Using limited goods to trade enforces opportunity cost. In other words, if I have a set amount of money, I can’t buy everything with it. I have to choose what I spend money on.

If there was no opportunity cost, I could buy an airplane and a car and a college education with the same money, and the creators of those goods would run out. Without opportunity cost, it is impossible to run a financial system.

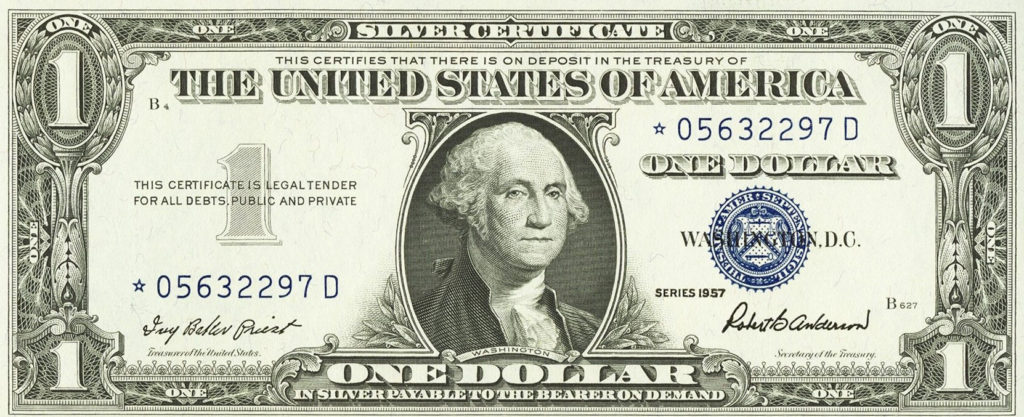

Over time, people stopped using gold and silver and started using paper that represented gold and silver. In the US, these were called Gold and Silver Certificates. They look like dollar bills. But they say “Silver Certificate” at the top. And it says “One Dollar in Silver Payable to the Bearer on Demand”.

What is a dollar of silver? I’m glad you asked.

“The law (US Coinage Act of 2 February 1792) defines a dollar as 371.25 grains of pure silver. This is a weight. A Constitutional dollar is an exact amount of silver by weight. A troy ounce is exactly 480 grains, thus a dollar is 371.25/480, or 0.7734 troy ounces of silver.”

That is what a dollar is, constitutionally. The law that defined that defined how many dollars in silver would make a dollar in gold. While that had some issues, the point is that there was a defined weight/measure of silver for a dollar.

Let’s compare to today. How much is the same weight of silver worth?

Today’s silver price: $21.79 per oz. * 0.7734 ozt = $16.85.

So, a ‘dollar’s’ worth of silver , by weight, from the constitution, is now worth $16.85. In other words, the printed paper dollars have become 1/16 as valuable as they are constitutionally mandated to be.

Eventually, silver and gold certificates were removed from circulation and now, you have a Federal Reserve Note which doesn’t represent money (gold or silver), but is a debt instrument. Without getting into that…

Why does this matter?

Because no one has any measure of what money is.

If you save ‘dollars’, they are constantly losing value.

And, because money doesn’t represent anything tangible at all, opportunity cost disappears. The govt can print a million dollars to lend for a college education or a house or a car, and no one has to forgo any other purchase to do so.

No opportunity cost.

What happens?

This expands the dollar supply.

It also enables the criminals who print the money to get assets for free. Imagine if you could print money and buy things with it.

That is exactly what they do.

Because we no longer have any definition of ‘dollar’, it’s like building a house with no definition of ‘inches’. No one knows the answer to questions like: “What is my retirement likely to cost? What will a college education cost in 20 years?”

If you don’t know the answers to these things, you can’t effectively plan.

For that reason, all anyone knows is that they need more. This is the reason crypto and other get-rich-quick schemes have taken off.

When I falsify and print money, I give you nothing at all for your labor and production. Just paper for your goods and services. Eventually, if I’m printing the money, it’s like the Monopoly board game. I own everything, you own nothing. You’re a slave. I’m the master.

What is a dollar worth? What should it buy?

This is the problem.

Nobody knows.

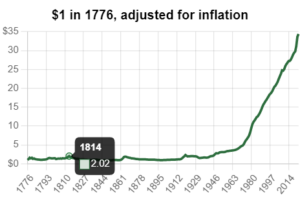

If you look at the charts here, you can see that there was no inflation from 1776 to 1913. Why? Because the measure of gold and silver remained the same. The money supply had to be ‘backed’ by precious metals, which could not be created out of thin air.

Once the gov’t got permission, via the Federal Reserve Act, to tamper with the money supply, whooosh, no one knew ‘the worth of a dollar’ anymore! And now, measured in all other goods and services, not just silver itself, it has lost 99% of its value.

And, although no one today knows what a dollar is, virtually no one seems to be bothered about it.

“The difference between the average American middle class and those living in the slums of Calcutta is credit card and mortgage debt.” – Me

In other words, if there were no debt, they would be homeless and broke. They have less net worth than the average slum dweller. They just don’t know it yet.

These bank runs and bank collapses (bankruptcies) are just symptoms of this underlying problem.

When the state creates money out of thin air (and the people use it, under threat of taxation and violence), money is stolen from those who save.

It is an act of theft. It is immoral.

If you’d like to understand these ideas in detail, Mike Mahoney is your man. Watch the videos at this link.

Addendum:

When the state creates too much money, inflation happens. Mike explains that in his videos.

When inflation begins to go parabolic (hyperinflation), which ends with complete worthlessness of the currency, the gov’t can try to reduce the money supply. Which is what it is doing now.

This is the game of musical chairs being played (money supply is shrinking), with SVB losing its chair (enough capital to keep going).

If the Fed endlessly increases the money supply, eventually the dollar becomes worthless. If it reduces the money supply to prevent that from happening, economic ‘pain’ like insolvencies and bankruptcies results.

Even if a gov’t or a king is completely corrupt and has a huge stash of stolen gold, at least it has to spend it to buy things, even if it’s to pay soldiers and police to harass people.

A gov’t that doesn’t have to spend real money has, for a time, endless power of despotism. Which is called empire: what the US enjoys now.

Objections:

TBC